Part 5- Funding Strategies

Welcome to the conclusion of our Network playbook. We've covered a lot of ground this week, from vertical scaling to horizontal expansion, and even how to combine the two.

Today, we're putting the cherry on top with funding strategies - the nox booster for your business growth.

Let’s get started:

Funding Strategies

- introduction to funding strategies

- determining your company's value

- types of funding options

- preparing for funding

Introduction to Funding Strategies

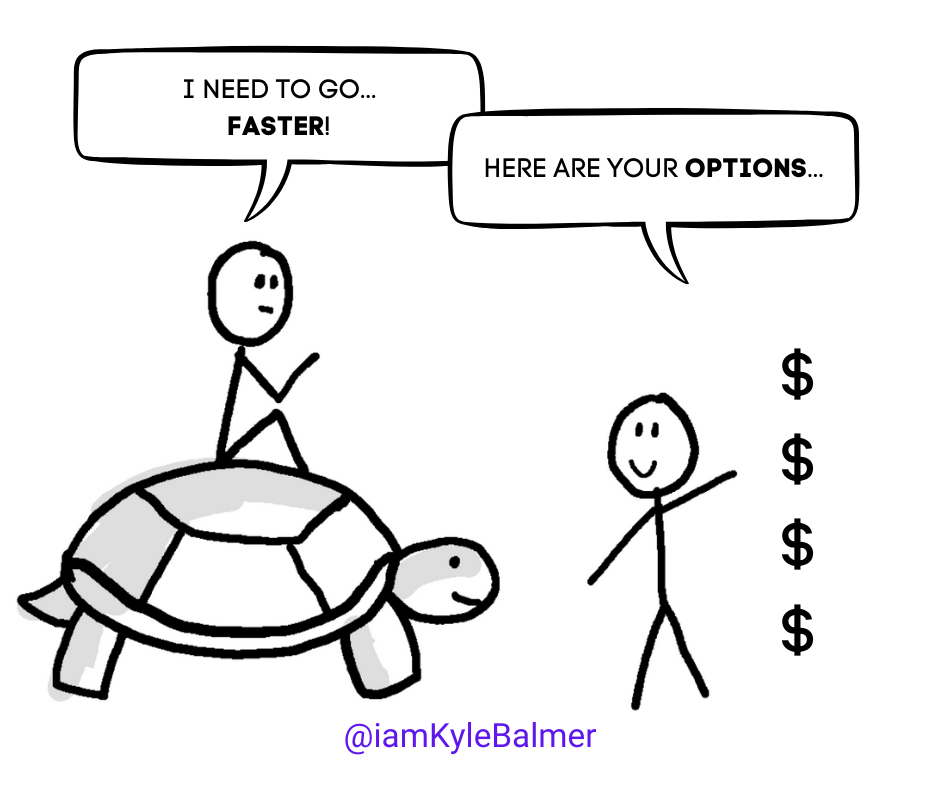

As you scale your business, you'll may reach a point where you need additional capital to fuel your growth. Funding strategies are all about finding the right sources of capital to support your scaling efforts.

They can help you grow faster, reach new markets quicker, and capitalize on opportunities. But like any business decision, choosing a funding strategy comes with both benefits and risks.

Honestly not all companies need funding. This is super important! It’s often seen as a vital step in growing a start-up but it really doesn’t have to be. If you are bootstrapping and funding your own internal growth (and hitting your personal financial goals) there is zero need to take on cash!

This Part of the Playbook is just to open up the option for you.

Let's break down the pros and cons:

Pros of external funding:

- Rapid growth potential: You can achieve in months what might otherwise take years.

- Ability to capitalise on market opportunities quickly: You'll have the resources to make fast moves.

- Access to expertise and networks: Especially with certain funding types, you're not just getting money, but valuable connections and mentorship.

Cons of external funding:

- Loss of control: Depending on the funding type, you might have to give up some decision-making power.

- Increased pressure and obligations: External funding often comes with expectations and deadlines.

- Risk of overleveraging: Taking on too much funding too quickly can put strain on your business.

Determining Your Company's Value

Before we dive into funding options, it's crucial to understand your company's value. This isn't just about impressing investors - it's about you having a clear, realistic picture of your business's worth and potential.

We need to know this so that we can accurately gauge what additional funding is worth to our business.

Now valuation is a huge subject. Whole departments at investment banks work this sort of stuff out. It’s not simple! But we’ll use a few methods to at least get us started.

There are several methods to calculate company value, but let's focus on three common approaches:

1. Multiple of Earnings: Take your annual earnings (usually EBITDA - Earnings Before Interest, Taxes, Depreciation, and Amortisation) and multiply it by a number based on your industry.

2. Discounted Cash Flow (DCF): Project your cash flows for the next 5-10 years, then discount them back to present value.

3. Asset-Based Valuation: Add up the value of all your assets, subtract your liabilities, and that's your company's value.

What we’ll do is run all three of these calculations and compare. I’ve written up a prompt to guide you through each calculation and come up with valuations for you. It will ask for information and (if you don’t know it) help you to work that info out.

Here’s the prompt:

You are an AI assistant specialising in business valuation. Your task is to help the user estimate their company's value using multiple methods. Use the following context and framework to guide your response:

Context:

Company valuation is crucial for making informed decisions about funding and growth strategies. Common valuation methods include multiple of earnings, discounted cash flow, and asset-based valuation.

Instructions:

1. Ask the user to provide the following information:

a. Annual revenue

b. Annual profit (EBITDA - Earnings Before Interest, Taxes, Depreciation, and Amortisation)

c. Industry type

d. Years in business

e. Projected growth rate for the next 3-5 years

f. Total value of company assets

g. Total liabilities

For each if they do not know provide context and instructions about how to calculate or work out these figures.

2. Calculate and explain three valuation estimates:

a. Multiple of Earnings Method:

- Use an industry-standard multiple (research based on the user's industry)

- Multiply annual EBITDA by this multiple

- Explain the reasoning behind the multiple used

b. Discounted Cash Flow Method:

- Project cash flows for the next 5 years based on provided growth rate

- Use a standard discount rate (e.g., 10-15% for small businesses)

- Calculate the present value of these cash flows

- Add a terminal value

- Explain each step of the calculation

c. Asset-Based Method:

- Calculate the net asset value (total assets minus total liabilities)

- Explain when this method is most appropriate

3. Provide a range of estimated company value based on these methods.

4. Explain factors that could increase or decrease the valuation, such as:

- Intellectual property

- Market position

- Team expertise

- Customer concentration

5. Recommend next steps, such as:

- Getting a professional valuation

- Focusing on areas that could increase value

- Preparing documentation to support the valuation

This will help get you started. For goodness sake don’t take it as gospel though! You know better than that! This is a starting point. Go and get professional advice as a next step ideally.

Types of Funding Options

Now that you have a ballpark figure of what your company's worth, let's explore your funding options:

- Bootstrapping and self-funding: This is reinvesting profits and possibly using personal savings. It's slow but gives you maximum control. Total valid option - there’s not always a need for external funding!

- Angel investors and venture capital: These investors are looking for high-growth potential and are willing to take big risks for big rewards. Angels work at lower end of funding levels, VCs at higher. They'll want equity in return, definitely in the case of VCs.

- Crowdfunding: This can be great for consumer products but might not work as well for B2B services.

- Bank loans and lines of credit: You'll need a solid credit history and often some collateral. The upside? You keep all your equity.

- Strategic partnerships and joint ventures: You each bring something to the table and share the rewards (and risks).

Each of these options has its own pros and cons, and the best choice depends on your specific situation, growth goals, and how much control you're willing to give up. Best to seek professional help here or chat with your mentor/coach at the very least.

Preparing for Funding

If you decide to seek external funding, you need to be well-prepared. Investors want to see that you have a solid plan and the ability to execute it.

Here's what you need to have ready:

- A business plan: This should outline your business model, market analysis, financial projections, and growth strategy. In the Business Playbook we talked about these sort of documentation for funding - we’re now at this point!

- Solid financial projections: Show how you plan to generate revenue and profit.

- Clear use of funds: Be specific about how you'll use the money and what milestones you'll achieve with it.

Let's use another prompt to help you prepare:

You are an AI assistant specialising in business development and fundraising. Your task is to help the user prepare for seeking funding. Use the following context and framework to guide your response:

Context:

Preparing for funding involves creating a compelling case for investment, including a solid business plan, financial projections, and a strong team. Different types of funding (e.g., venture capital, bank loans) may require different preparation strategies.

Instructions:

1. Ask the user to provide the following information:

a. Type of funding they're considering (e.g., VC, angel investment, bank loan)

b. Current stage of business (e.g., startup, growth phase)

c. Amount of funding sought

d. Primary use of funds

e. Current team composition

2. Based on the funding type and business stage, provide guidance on preparing:

a. Business Plan:

- Outline key sections to include

- Suggest specific points to emphasize based on the funding type

b. Financial Projections:

- List essential financial statements to prepare

- Suggest key metrics to highlight (e.g., CAC, LTV, burn rate)

c. Pitch Deck:

- Outline essential slides to include

- Provide tips for effective presentation

d. Team and Advisors:

- Suggest roles or expertise to highlight or acquire

- Advise on building an advisory board if applicable

3. Provide a checklist of documents and materials to prepare, such as:

- Legal documents (e.g., incorporation papers, contracts)

- Intellectual property documentation

- Market research and competitive analysis

4. Suggest ways to strengthen the company's position, such as:

- Achieving specific milestones before seeking funding

- Building strategic partnerships

- Gaining early customers or users

Again this prompt is to get you started. This is a big job! I’ve written another complete Playbook on funding which is a good next step.